FMP

Financial Estimates API: How traders can use those estimates to analyze shares. Examples provided.

May 06, 2025

The Financial Estimates API is a valuable tool that provides traders with forward-looking data on a company's financial performance. It offers analyst forecasts on key metrics such as:

Revenue (Low, High, and Average)

EBITDA and EBIT

Net Income

Earnings Per Share (EPS)

Number of Analysts contributing to estimates

This API helps traders gain insight into market expectations before earnings reports are released. By analyzing trends in estimates, they can make more informed decisions about buying, holding, or selling a stock.

How Traders Can Use the Financial Estimates API

Here's how traders benefit from this endpoint:

1. Forecast Trends: Identify whether expectations for revenue or EPS are rising or falling.

2. Valuation Modeling: Use EPS estimates to compute forward P/E ratios, making it easier to assess if a stock is overvalued or undervalued.

3. Earnings Season Strategy: Prepare for earnings reports by comparing current price levels to expected earnings performance.

4. Compare Analyst Sentiment: A higher number of analysts can indicate more market attention or confidence.

AAPL Forecast Analysis Using Financial Estimates API

Let's take a look at Apple Inc. (AAPL) and analyze its forecast over the next few quarters using the data retrieved from the Financial Estimates API.

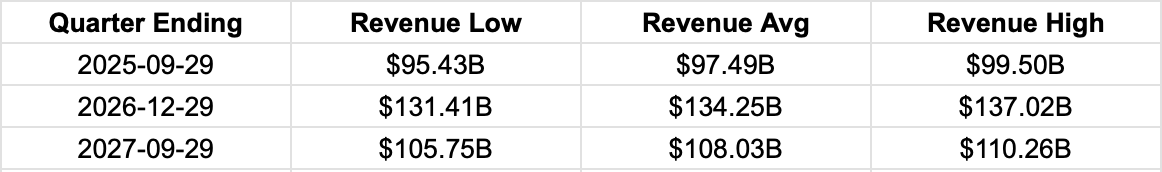

Revenue Estimates (Quarterly)

Observation: Analysts expect Apple's revenue to grow steadily through 2026 and 2027. The high-end estimate for Q4 2026 is over $137 billion.

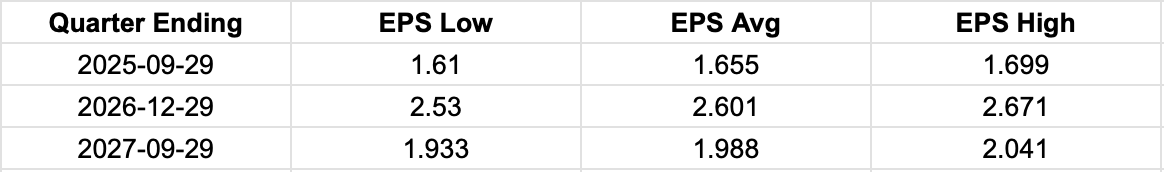

EPS (Earnings Per Share) Trends

Insight: EPS estimates show growth over time, peaking in the December 2026 quarter, which is likely due to seasonal holiday sales. AAPL is projected to earn nearly $2/share in late 2027.

Strategic Takeaways for Traders

Rising EPS and steady revenue growth suggest bullish sentiment.

High analyst coverage (13-25 analysts per metric) increases confidence in these forecasts.

Use these forecasts to calculate forward valuation ratios like P/E.

Combine this data with historical trends, price action, and macroeconomic indicators to build a solid investment thesis.

The Financial Estimates API gives traders a crystal ball into the future of a company's performance. With access to high-quality, analyst-driven data, investors can anticipate earnings surprises, adjust their portfolios, and better understand a stock's potential.

In the case of Apple, the API data paints a picture of a consistently growing company with strong projected earnings. This makes AAPL an attractive stock to watch for long-term investors and short-term traders alike.

How an Economic Moat Provides a Competitive Advantage

Introduction In the competitive landscape of modern business, companies that consistently outperform their peers ofte...

Apple’s Slow Shift from China to India: Challenges and Geopolitical Risks

Introduction Apple (NASDAQ: AAPL) has been working to diversify its supply chain, reducing dependence on China due to...

Taiwan Semiconductor Manufacturing Company (NYSE: TSM) Surpasses Earnings Expectations

Taiwan Semiconductor Manufacturing Company (NYSE: TSM) is a leading player in the global semiconductor industry. Known f...