FMP

How to Pick Great Investment Ideas Using Financial Modeling Prep APIs

Jul 02, 2025

Investing in the stock market can feel like searching for a needle in a haystack. With thousands of companies to choose from, how do you find the ones worth your money? The good news is that tools like the Financial Modeling Prep (FMP) API make it easier to dig through financial data and spot promising stocks. In this article, I'll walk you through a simple, step-by-step guide to choosing investment ideas using FMP's API endpoints.

Why Use the Financial Modeling Prep API?

The FMP API is like a treasure chest of financial data. It gives you access to real-time stock prices, company financials, analyst ratings, and more. Whether you're looking for undervalued stocks, companies with strong growth, or businesses with solid financial health, FMP's endpoints can help you make informed decisions. Plus, it's user-friendly. Let's dive into how you can use this tool to find great investment ideas.

Step 1: Define What Makes a Great StockBefore you start pulling data, think about what makes a stock a good investment for you. Here are some factors to consider:

- Strong Financial Health: Look for companies with low debt, steady cash flow, and solid balance sheets.

- Growth Potential: Companies with consistent earnings growth or expanding markets are often winners.

- Undervaluation: Stocks trading below their true value can be great buys.

- Analyst Support: Stocks with positive analyst ratings often have strong market confidence.

Step 2: Sign Up and Get Your API Key. To use the FMP API, you need an API key. Once you verify your email, you'll get an API key from the dashboard. This key lets you access FMP's data.

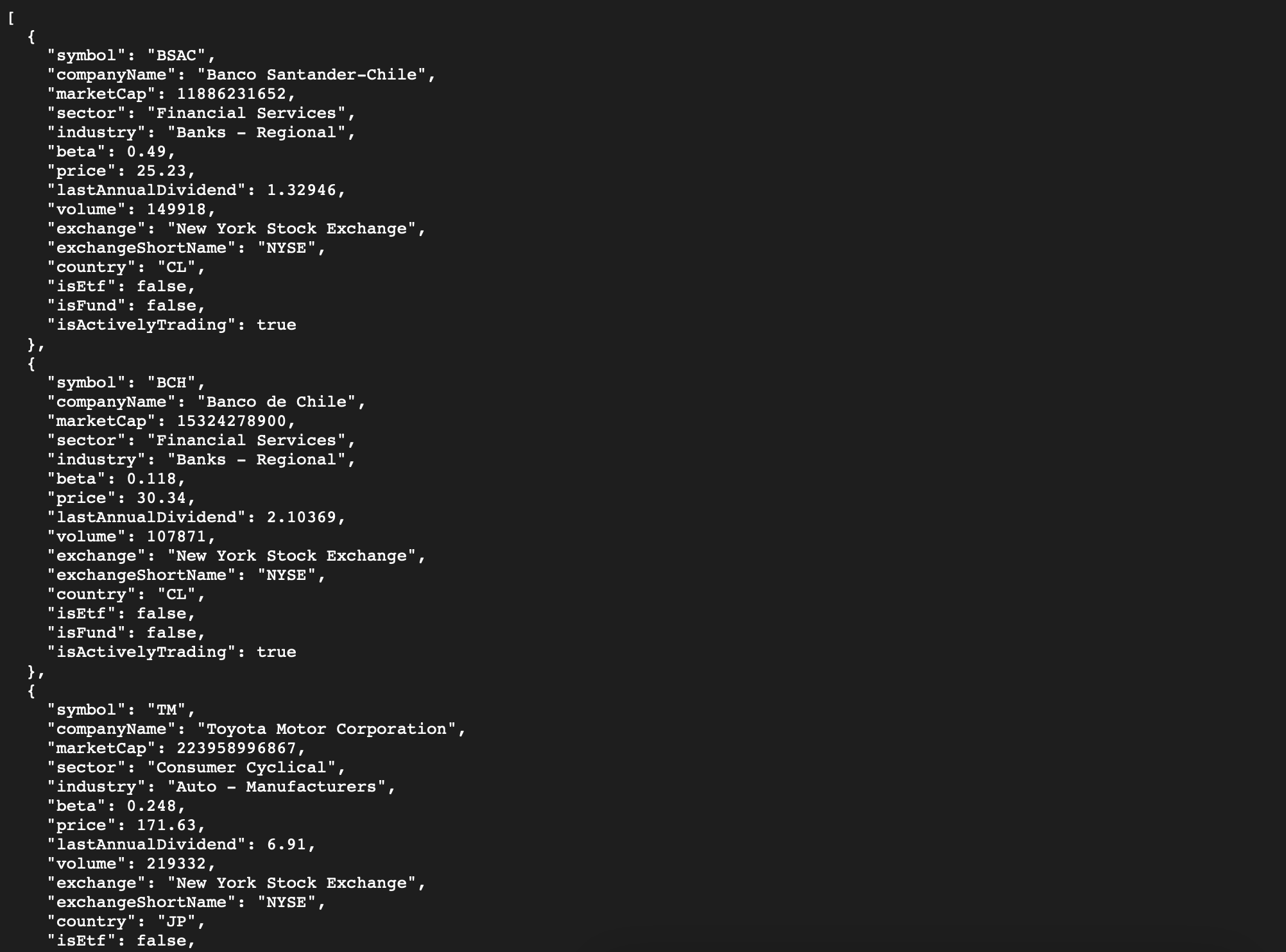

Step 3: Screen for Strong Stocks with the Stock Screener API. The Stock Screener API is a great place to start. It lets you filter stocks based on specific criteria like market cap, price, volume or Beta.

For example, you might want companies with a low Beta (less volatile stocks) or a high market capitalization (more stable, larger companies).Here's how to use it:

- Example: Let's say you want stocks with a market cap over $10 billion, and a Beta lower than 1 Your request might look like this:

https://financialmodelingprep.com/api/v3/stock-screener?marketCapMoreThan=10000000000&betaLowerThan=1&apikey=YOUR_API_KEY

- What You Get: A list of companies matching your criteria, including their ticker symbols, names, and key metrics.

Step 4: Check Financial Health with the Company Profile Data API and Financial Statements Growth APIs. Once you have a shortlist, dig deeper into each company's financial health. The Company Profile Data API gives you a quick overview of a company, including its industry, market cap, and beta (a measure of risk). The Financial Statements Growth API provides detailed data like income statements growth, balance sheets statement growth, and cashflow statement growth.

- Company Profile Data Endpoint:

https://financialmodelingprep.com/stable/profile?symbol=AAPL&apikey=your_api_key

This returns info like Apple's CEO, industry (Technology), and market cap. Check if the company operates in a growing sector like tech or renewable energy.

- Income Statement Growth Endpoint:

https://financialmodelingprep.com/stable/income-statement-growth?symbol=AAPL&apikey=your_api_key

Look at revenue and net income trends. Are they growing year over year? Consistent growth is a good sign.

- Balance Sheet Growth Endpoint:

https://financialmodelingprep.com/stable/balance-sheet-statement-growth?symbol=AAPL&apikey=your_api_key

Growing debt can be a bad sign as it can create liquidity issues.

For example, if a company's revenue is growing but its debt is low, it might be a solid investment. Compare these metrics across your shortlist to spot the strongest candidates.Step 5: Find Undervalued Stocks with the DCF Valuation API. To find stocks that are trading below their true value. This endpoint estimates a company's intrinsic value based on its future cash flows.

- Endpoint:

https://financialmodelingprep.com/stable/discounted-cash-flow?symbol=AAPL&apikey=custom_api_key

- What You Get: The DCF value compared to the current stock price. If the DCF value is higher than the market price, the stock might be undervalued.

Step 6: Gauge Market Sentiment with the Financial Estimates and Stock News API. Market sentiment can influence a stock's performance. Use the Financial Estimates API to see what analysts predict for a company's future revenue and earnings per share (EPS).

- Endpoint:

https://financialmodelingprep.com/stable/analyst-estimates?symbol=AAPL&period=annual&page=0&limit=10&apikey=custom_api_key

- What You Get: Forecasts for revenue, EPS, and more. Strong projections suggest analysts are bullish on the stock.

- Endpoint:

https://financialmodelingprep.com/stable/news/stock?symbols=AAPL&apikey=custom_api_key

- What You Get: News articles about the company. Positive news (like new product launches) can signal growth potential, while negative news (like lawsuits) might be a red flag.

Step 7: Track Institutional Investors with the Form 13F by using the Filings Extract API endpoint. I've written an article where I explain how to pull form 13F data from the endpoint. Big investors like hedge funds often have deep market insights. The Form 13F shows what stocks institutional investors are buying or selling. This data can confirm whether your picks align with what the “smart money” is doing.

Step 8: Build a Shortlist and Diversify. Now that you've used these APIs, you should have a list of stocks that are financially healthy, undervalued, and backed by positive sentiment. Here's how to finalize your investment ideas:

- Compare Metrics: Rank your shortlist based on key metrics like growth, valuation, and analyst estimations.

- Diversify: Don't put all your money in one stock. Spread your investments across industries (e.g., tech, healthcare, energy) to reduce risk.

The Financial Modeling Prep API is a powerful tool for finding great investment ideas. By using endpoints like the Stock Screener, Company Profile, DCF, Financial Estimates, and pulling useful data from the Form 13F, you can uncover stocks with strong fundamentals, undervaluation, and market support. Whether you're a beginner or a pro, FMP makes it easy to access the data you need to invest smarter. So, grab your API key, start exploring, and build a portfolio that grows your wealth!

Apple’s Slow Shift from China to India: Challenges and Geopolitical Risks

Introduction Apple (NASDAQ: AAPL) has been working to diversify its supply chain, reducing dependence on China due to...

MicroStrategy Incorporated (NASDAQ:MSTR) Earnings Preview and Bitcoin Investment Strategy

MicroStrategy Incorporated (NASDAQ:MSTR) is a prominent business intelligence company known for its software solutions a...

WACC vs ROIC: Evaluating Capital Efficiency and Value Creation

Introduction In corporate finance, assessing how effectively a company utilizes its capital is crucial. Two key metri...